I remember the first time I overheard a friend talking about investing in a local bakery. I was intrigued. Why would someone want to invest in such a small venture when there are big companies out there?

Over time, and after exploring the world of investments, I realized the allure of these trades. They’re not just about pastries and fresh bread; they’re about potential, growth, and real, tangible impact. Let’s see why so many investors, like my friend, are drawn to small business owners.

The Potential for High Returns

One of the primary reasons is the potential for high returns. While investing in established corporations might offer stability, the growth potential of a small business can be unparalleled.

These trades often operate in niche markets or introduce innovative products and services. This uniqueness can lead to rapid growth, especially if the business taps into a previously unmet need or trend.

For investors, this means the potential for their investment to multiply significantly in a short period.

Lower Initial Investment

Compared to investing in large corporations, the initial capital required to invest in a small business is often lower. This allows investors to diversify their portfolios by investing in multiple trades, spreading the risk, and increasing the chances of landing a successful venture.

Direct Influence and Control

Unlike investing in large corporations where an individual’s stake might be minuscule, investing in a small business often comes with the opportunity to exert direct influence and control.

Active Role in Decision-Making

Investors often have the chance to take on roles such as board members or advisors. This active involvement allows them to steer the business in a direction that aligns with their vision and expertise, potentially increasing the chances of success.

Having a direct say in business decisions also means that investors can manage risks more proactively. They can push for changes or strategies that they believe will mitigate potential threats, ensuring that their investment is well-protected.

The Appeal of Tangible Impact

Beyond the financial rewards, many investors are drawn to small trades because of the tangible impact they can have on communities, industries, and innovation.

Investing often translates to job creation and economic stimulation in local communities. Investors not only see financial returns but also the satisfaction of knowing they’re making a difference in people’s lives.

Fostering Innovation

Small businesses are often at the forefront of innovation. By investing in them, investors are supporting the development of new products, services, and solutions that can revolutionize industries and improve lives.

Diversification of Portfolio

Diversification is a cornerstone of investment strategy. These businesses offer a unique asset class that can help investors spread their risks.

While small trades can be riskier, they also come with the potential for higher rewards. By including them in their portfolio, investors can balance out the steadiness of blue-chip stocks with the dynamism of startups.

Exposure to Emerging Markets

Many small businesses operate in emerging markets or sectors. Investing in these ventures gives investors a front-row seat to the latest trends and developments, ensuring that their portfolio remains relevant and forward-looking.

Emotional and Personal Connection

Investing isn’t always just about numbers. The personal connection and passion that often come with these investments can be a significant draw for many investors.

Small trades are often born out of passion. Investors get the chance to support and be part of ventures that are driven by genuine enthusiasm and commitment, which can be incredibly fulfilling.

Also, investing in a small business often means building a close relationship with the founders and team. This personal connection can lead to a more profound sense of trust and collaboration, making the investment journey more rewarding.

Flexibility and Adaptability

In a rapidly changing world, the ability to adapt is crucial. Small trades often have this adaptability in spades, making them attractive to investors.

Without the bureaucratic layers of large corporations, these businesses can make decisions quickly. This agility allows them to pivot in response to market changes, ensuring they remain competitive.

Customized Investment Terms

Investing in a small business often means there’s room for negotiation. Investors can work out terms that suit their needs and preferences, leading to a more tailored investment experience.

Potential for Long-Term Partnership

Many investors are not just looking for a quick return. They’re seeking long-term partnerships that can provide sustained benefits.

As these trades grow, they might need further rounds of funding. Early investors often get the first chance to reinvest, allowing them to deepen their stake and continue benefiting from the business’s success.

The relationships built during the early stages of a business can last a lifetime. Investors often find themselves in a network of trusted partners, collaborators, and allies, opening doors to future opportunities.

Moreover, some investors might opt to dive into entrepreneurship by purchasing an established venture, ensuring a level of stability and ongoing operations from the get-go.

Learning and Personal Growth

Investing in small businesses can be a journey of learning and personal growth. It offers insights and experiences that are hard to come by elsewhere.

Every small trade operates in its unique context. By investing in diverse ventures, investors can gain a deep understanding of various industries, trends, and business models.

Developing Business Acumen

The hands-on nature of these investments means that investors often get involved in various aspects of the business. This involvement can sharpen their business acumen, making them better investors and entrepreneurs.

Tax Incentives and Benefits

Governments around the world recognize the importance of these businesses. As a result, there are often tax incentives and benefits associated with investing in them.

Many countries offer tax breaks or credits for investments in startups or small businesses. These incentives can significantly boost the overall returns for investors.

By taking advantage of these tax incentives, investors are also playing a part in national growth. Their investments support job creation, innovation, and economic development, which can lead to a healthier economy overall.

The Thrill of the Journey

Lastly, there’s an intangible yet undeniable thrill associated with investing in small businesses. It’s a journey filled with ups and downs, but the rewards – both financial and emotional – can be immense.

Investors have the chance to be part of these success stories from the very beginning, witnessing every milestone and challenge.

The close-knit nature of investments means that successes are celebrated together. Every achievement becomes a shared joy, making the investment journey all the more memorable.

FAQs:

How do I start investing in these?

Starting your investment journey in small businesses typically begins with research. Identify industries or sectors you’re passionate about or see potential in.

Networking events, local business associations, and platforms like AngelList or SeedInvest can connect you with owners looking for investors.

What are the risks?

Like all investments, there are risks involved. Small trades can be vulnerable to market fluctuations, competition, and operational challenges. There’s also the risk of the business failing, which could result in a loss of your investment.

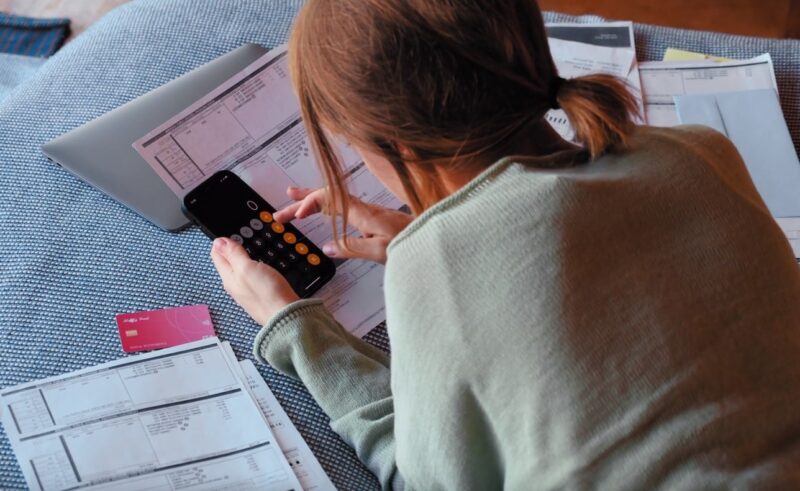

It’s essential to conduct thorough due diligence and possibly consult with financial advisors before investing.

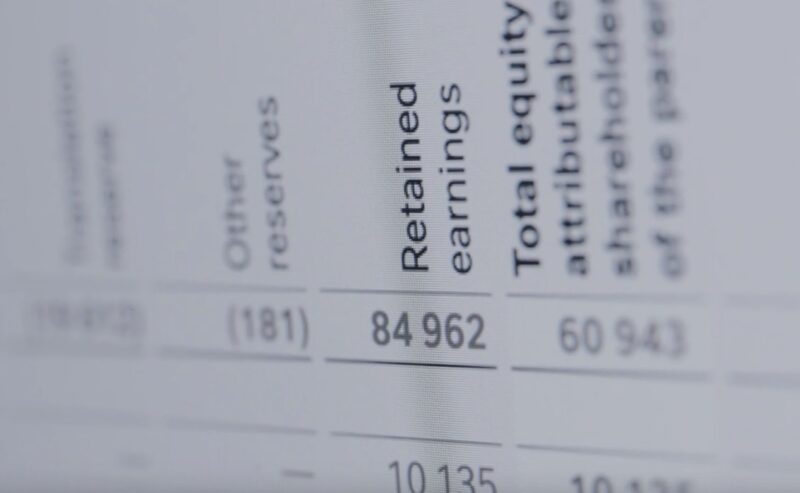

How can I assess the potential of a business before investing?

Look for a solid business plan, a clear value proposition, and a capable management team. Financial statements can give insights into the business’s health.

Additionally, consider the market size, growth potential, competition, and the business’s unique selling points. Engaging with existing customers or clients can also provide valuable feedback.

Can I exit my investment if I change my mind?

Exiting an investment in a small business can be more challenging than liquidating stocks or bonds. Your exit strategy should be discussed and outlined before investing.

Options might include selling your stake back to the business owners, to another investor, or waiting for a larger company to acquire the business.

Are there any legal considerations?

Absolutely. It’s crucial to have a clear legal agreement outlining the terms of your investment, your rights as an investor, and any other conditions or clauses relevant to the partnership. It’s advisable to consult with a legal professional to ensure all parties are protected.

Final Thoughts

After this, I hope you can see small trades in a new light, just as I did. Investing in them is not just about money; it’s about being part of a journey, a story, and making a real difference.

Whether you’re thinking of investing or just curious, remember that every big corporation once started as a small business. And who knows? The next one you come across might just be the next big thing.